Optimize your marketing campaigns and sales funnels by offering smart recommendations and upsells. And proactively meet customers’ needs.

ERP INTEGRATION PLATFORM FOR DISTRIBUTORS

Make your systems talk

to each other.

DCKAP Integrator connects your ERP system with eCommerce store, CRM, inventory,

accounting, logistics, marketplaces, and other applications—so data flows

between them automatically and in real time.

TRUSTED BY FAST-GROWING DISTRIBUTORS IN NORTH AMERICA

We’ve got your back end.

So you can work on your front end.

No more hours spent copying info between systems, finding items, and resolving issues.

DCKAP Integrator lets you harness the power of flowing data to drive growth across the

business. And you can double down on what you’re actually here to do: create and

deliver extraordinary customer experiences.

Ramp up sales and marketing.

Give customers more freedom.

Let customers see real-time inventory and pricing. And allow them to manage their accounts, orders, and tracking all by themselves.

Keep control of inventory.

Keep inventory levels accurate across all systems in real-time to prevent overselling and underselling. And prevent customer disappointment.

Access real-time data.

With all your data in a centralized hub, you can find what you need in seconds. Cutting down on unforced mistakes, misalignment. and customer service wait times.

Expedite order cycles.

Customer orders now copy automatically to your ERP and from your ERP to shipping. To automate order fulfillment and get customers their orders, faster.

Slash time to market.

Automate the addition of new products to your store, and changes to products or pricing. So customers are always viewing up-to-date product information.

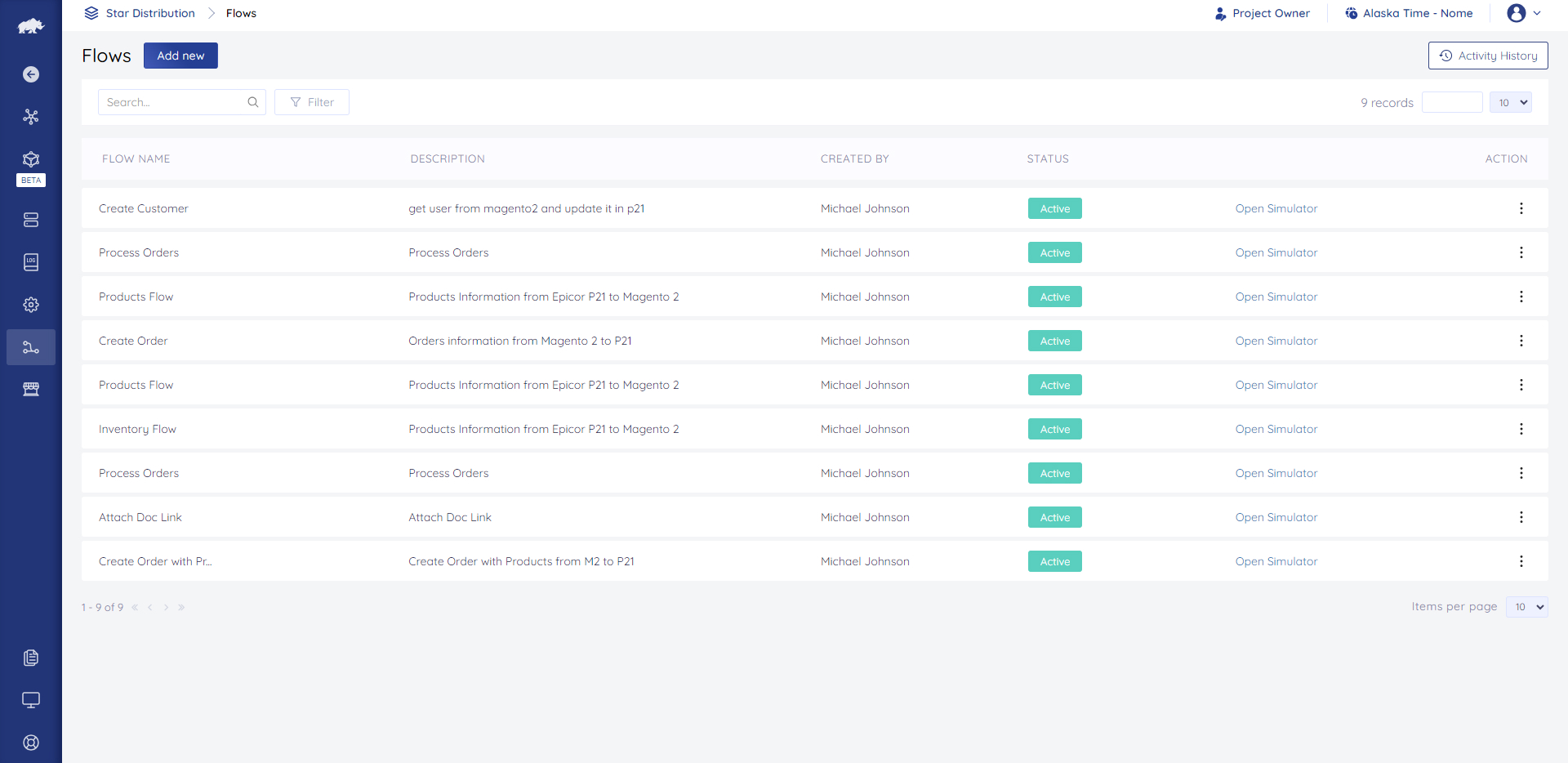

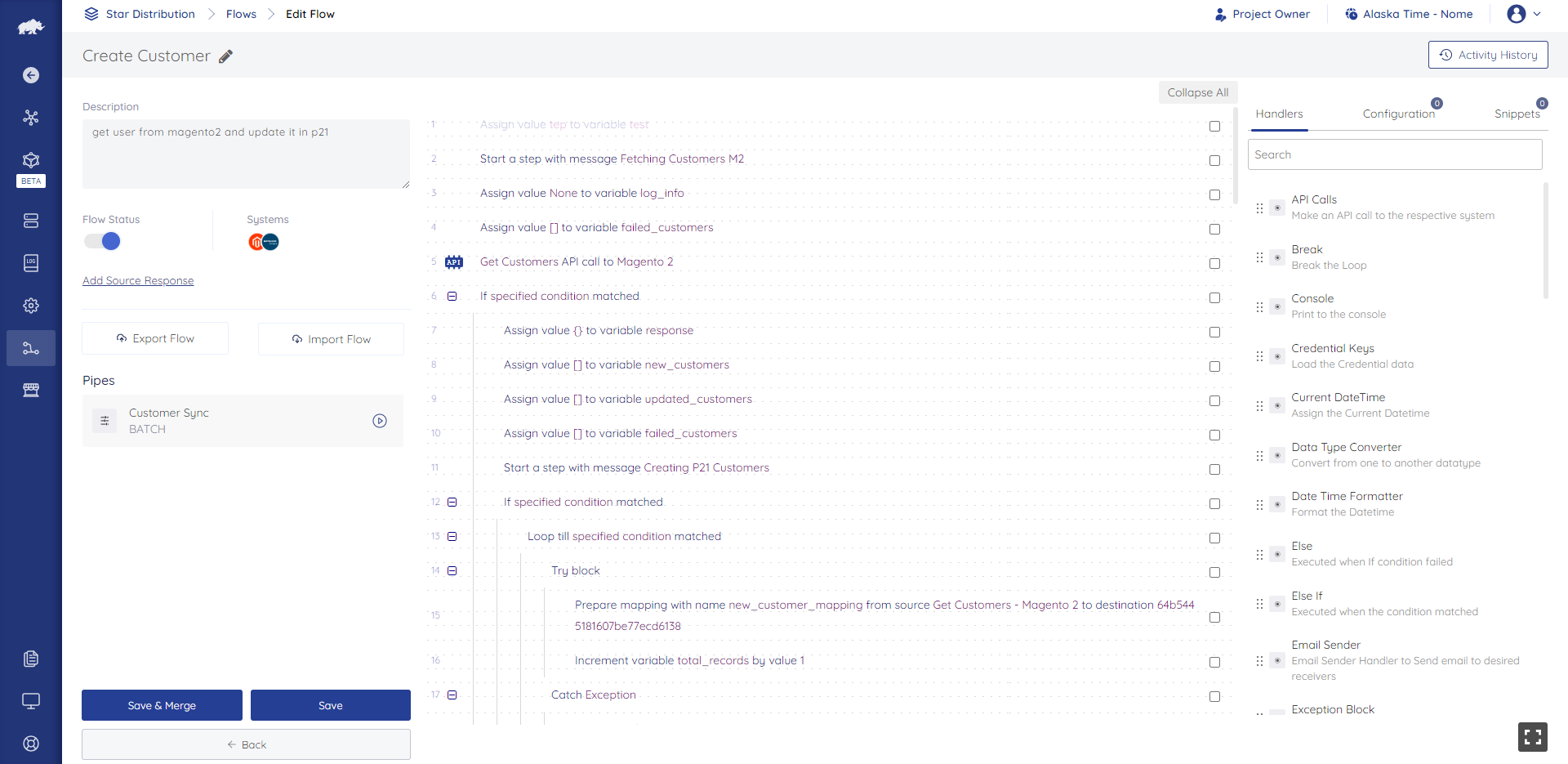

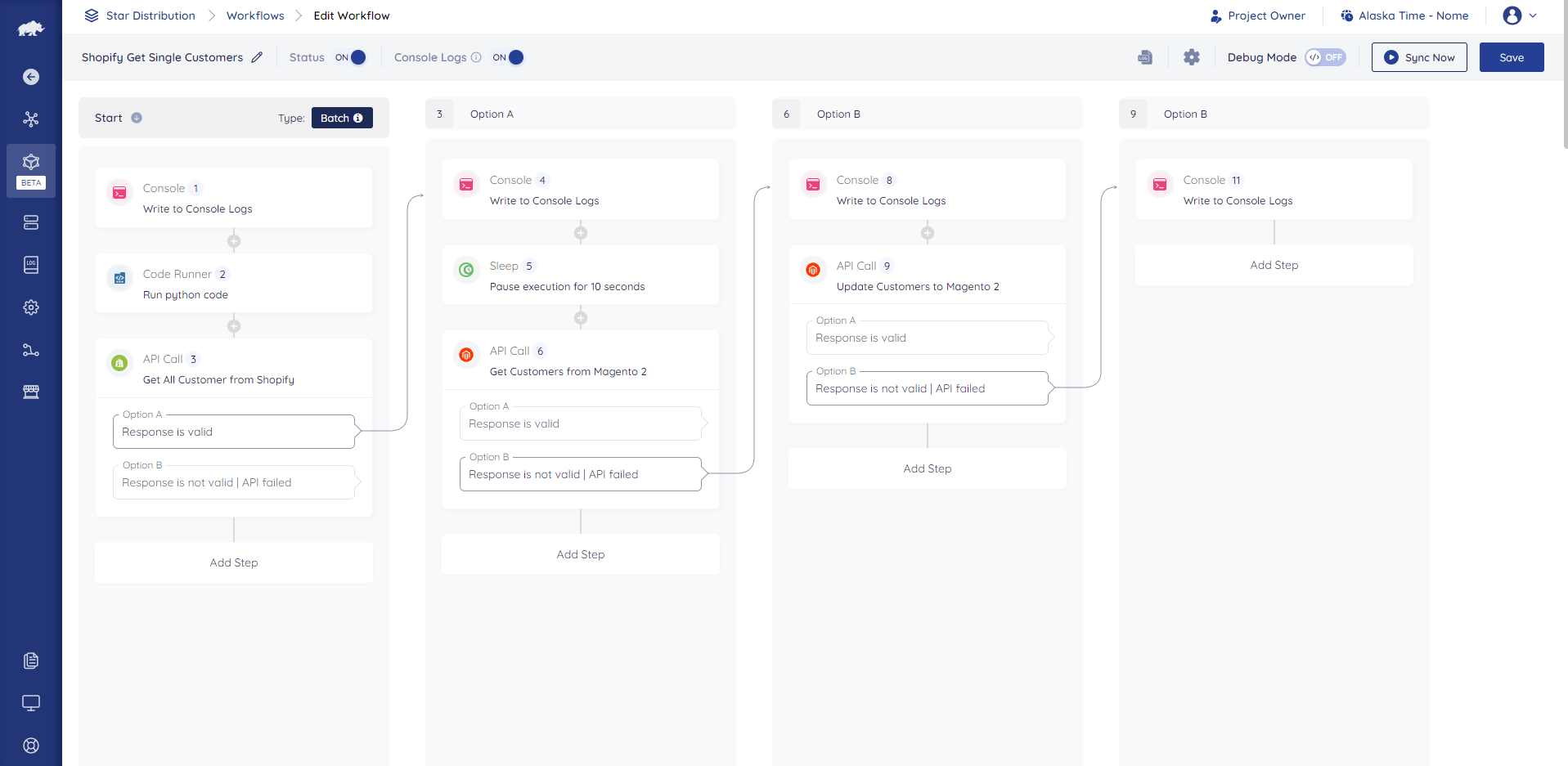

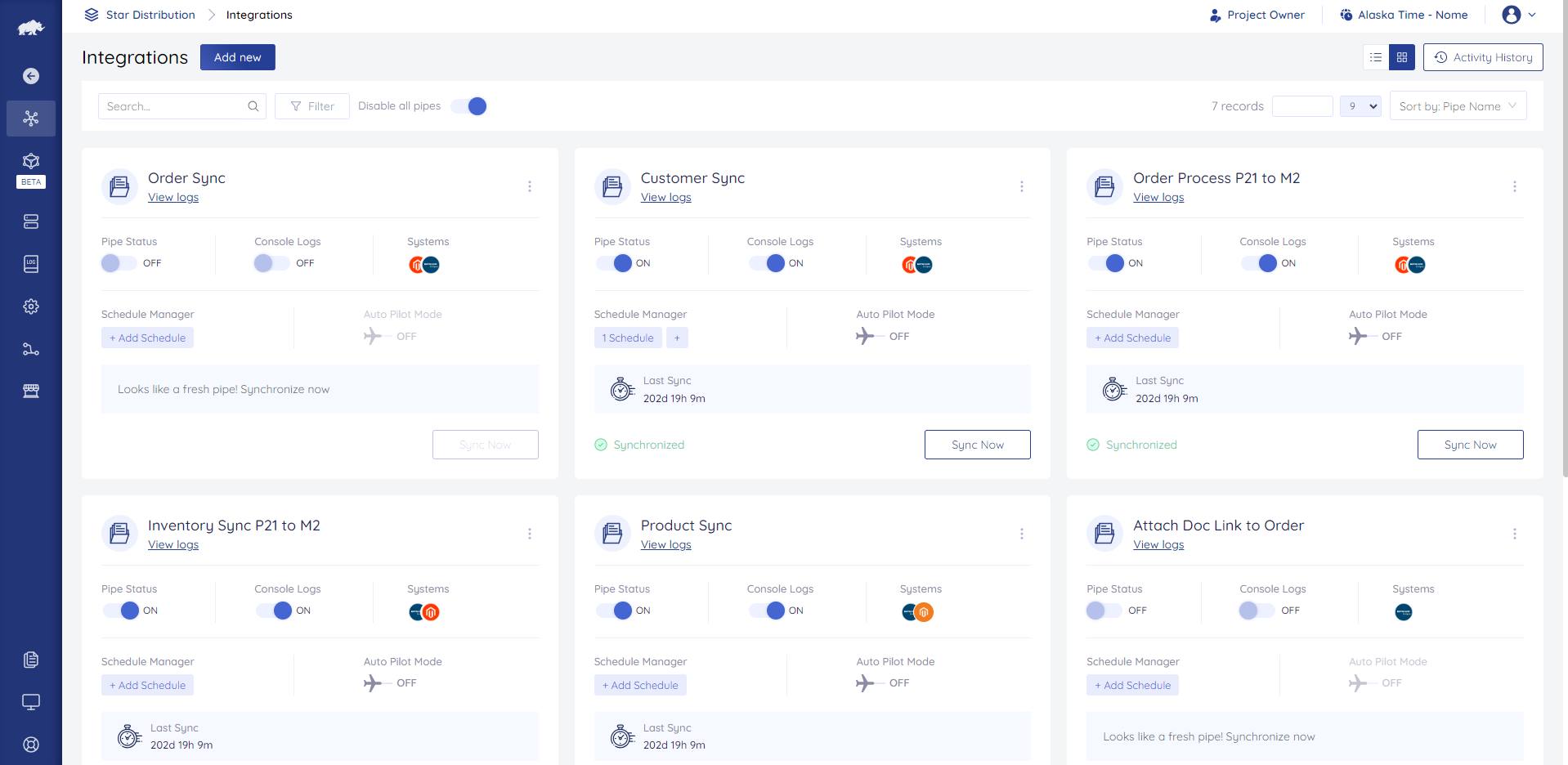

Take a look at how it works.

Why DCKAP Integrator?

It’s surprisingly simple.

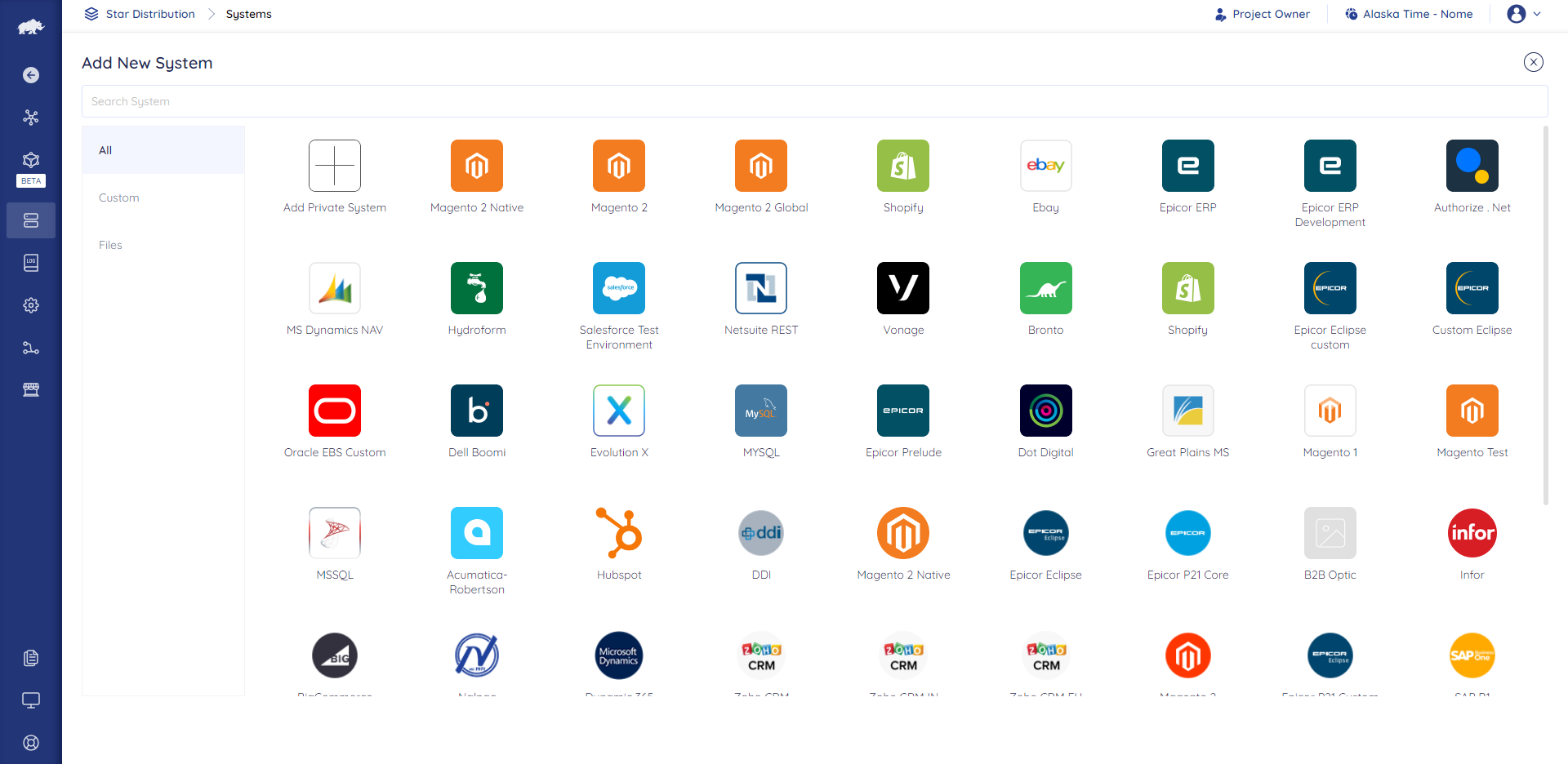

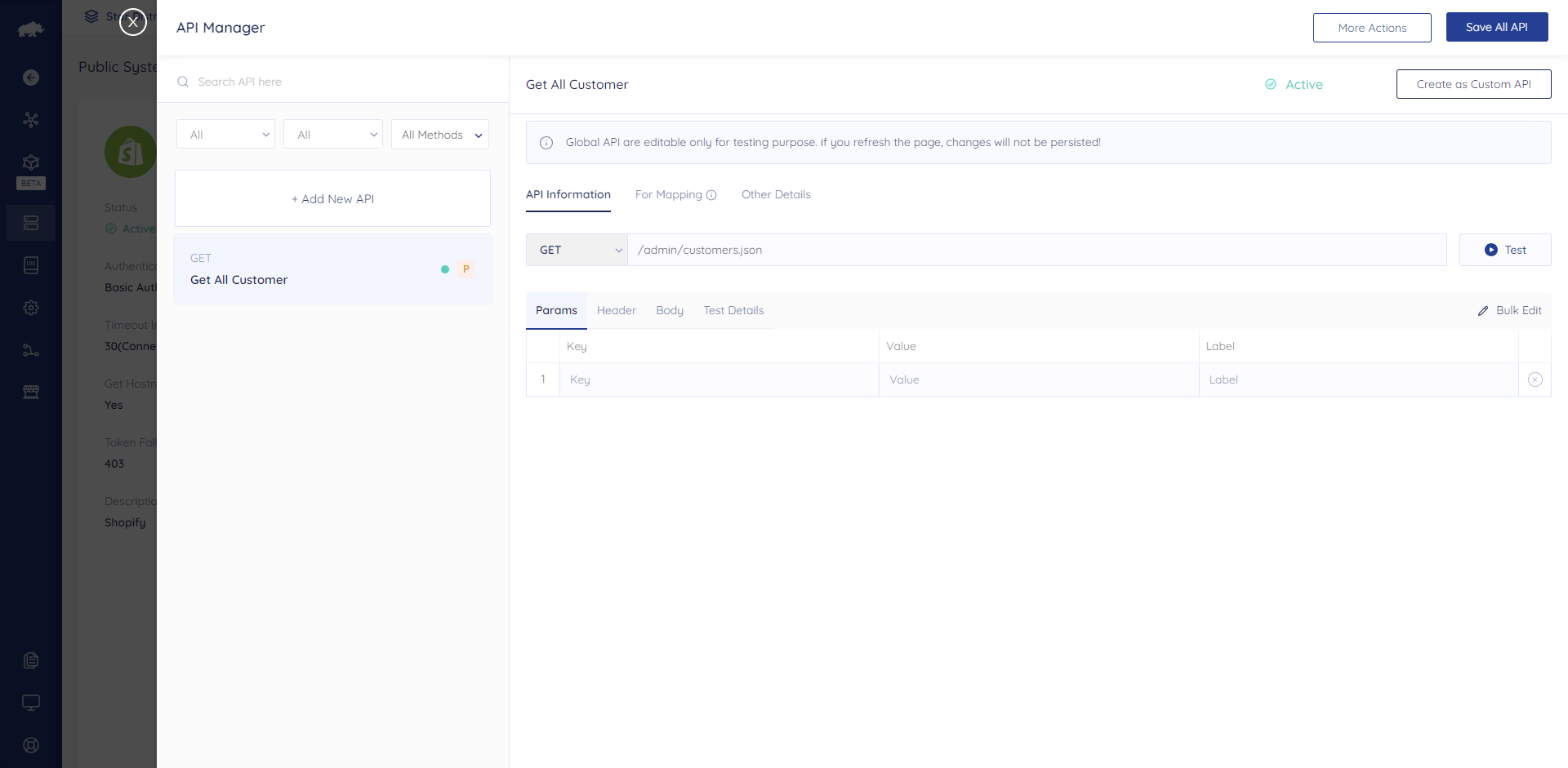

Connect your systems in a few clicks with our out-of-the-box pipelines. Or let our team customize integrations for you for any system that has an API.

Easily manage exceptions, make changes, and view detailed analytics and forecasts.

And surprisingly powerful.

Set it, test it, and forget it. DCKAP hums reliably in the background, no maintenance needed.

Automated, bi-directional transfers work in real-time, or at preset intervals. And there’s no limit to the amount of data you can sync.

Leading distributors power their operations with DCKAP Integrator.

Rene Escamilla

Director of Ecommerce

One of the main problems that has been solved is customer data and inventory levels in real time and in return allowing us to grow our business at a fast pace. DCKAP’s customer service and attention to updating our connections is unmatchable. With website integrations constantly changing, DCKAP is quick on their feet. The team will always find a solution promptly.

Rodrigo Neves

Director of IT

We can monitor all parts of our integration and have the flexibility to change the integration with just a few clicks. Also, we now have the possibility to integrate DCKAP Integrator with our own API, and that is giving us the flexibility to create new modules on our eCommerce platform without having to rely on a third party developer to create the integration for us. You will have control over the entire process, have visibility over transactions, and the ability to change.

Danny Silverman

President & COO

Integrations can be tricky, and the DCKAP team stuck with it until everything was perfect, even when it required multiple rounds of tweaking and testing. They took the time to understand our ERP platform and its requirements and were great at working independently to figure out the best approach. DCKAP Integrator product has proven to be reliable, performant, and scalable. It provides ample logging and reporting and supports a variety of use cases.

Andy Cipra

CEO, Vitabox

DCKAP allows us to exchange data between our partners and the marketplaces seamlessly. These must always be on and accurate, and we can count on DCKAP for this! We have worked with DCKAP for over a year and have always had excellent customer service, communication and troubleshooting support.

BEST-IN-CLASS SUPPORT ACROSS

E-COMMERCE DATA INTEGRATION & API MANAGEMENT CATEGORIES