Smarter B2B Credit Management for Distributors

Empower your customers with flexible credit-based purchasing through DCKAP Commerce’s Distributor Credit System.

Seamless Credit Management for Distributors

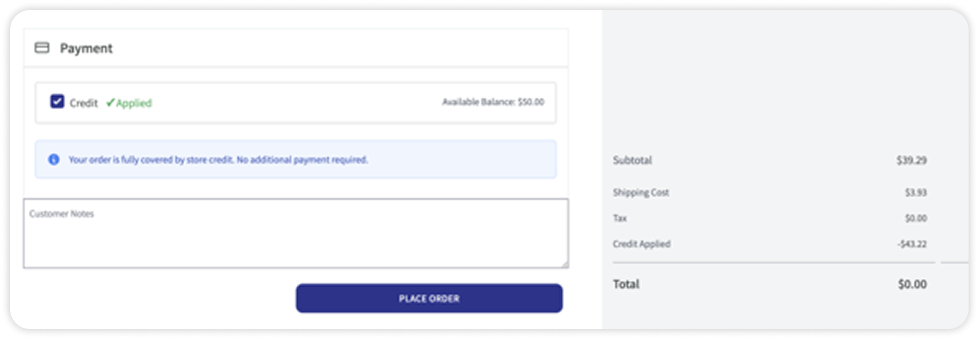

Streamlined Credit-Based Purchasing

Simplify the buying process for your customers with pre-approved Customer Credit Limits in eCommerce. Instead of waiting for invoices or processing manual payments, customers can purchase instantly using their assigned credits, improving both efficiency and cash flow.

- Allow customers to make purchases using available credits at checkout.

- Enable faster reorders and repeat purchases without manual approvals.

- Enhance the customer experience with flexible payment options.

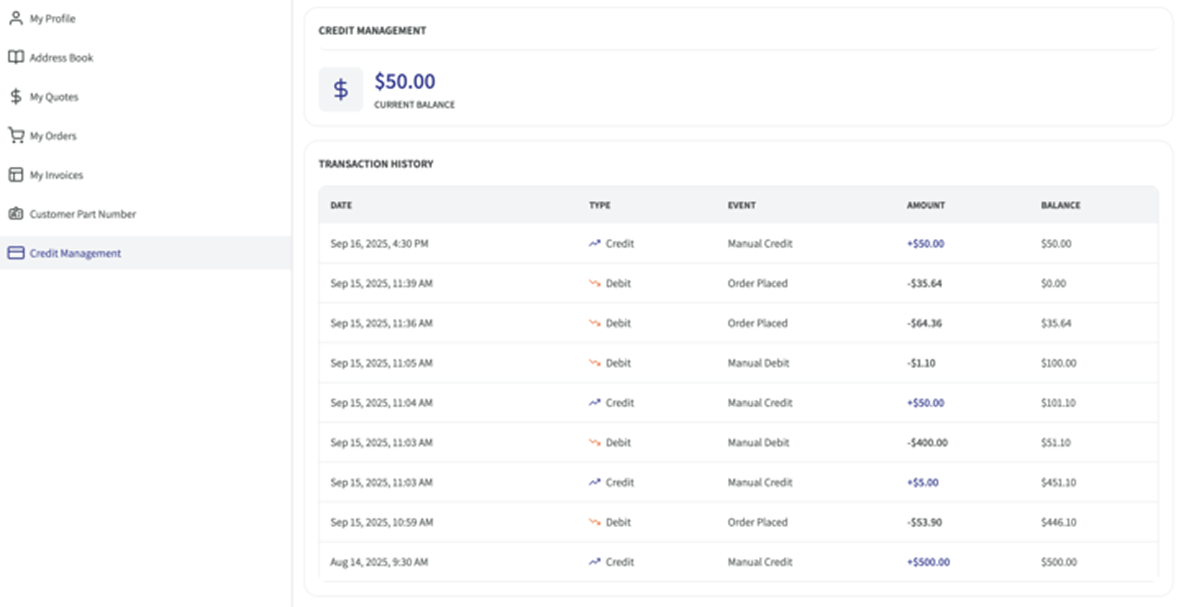

Full Control with Automated Credit Limit Management

Manage each customer’s credit seamlessly through the B2B Credit Management System in DCKAP Commerce. You can set limits, monitor usage, and automate restrictions when balances are exceeded, ensuring full financial control and transparency.

- Assign unique credit limits for each company or customer account.

- Automatically restrict orders once the limit is reached.

- Provide real-time visibility of available and used credit.

Real-Time Tracking and Transparency

Distributors and customers both gain visibility into credit usage, balances, and payment history. Keep transactions transparent while reducing billing disputes.

- View real-time credit balance updates across all accounts.

- Generate reports for credit usage, repayment, and limits.

- Keep both admin and customers informed with automated notifications.

Overcoming Everyday Credit Management Pain Points

Credit Management Made Simple for Distributors

Payment Delays

Enable faster order placements without waiting for invoice payments.

Manual Credit Tracking

Eliminate spreadsheets with automated credit updates and alerts.

Lack of Visibility

Provide real-time visibility of credit usage for both customers and admins.